Now that lockdown is nearing its end and we’re allowed back out in the real world again, I’m sure many of us are regretting letting ourselves gain those extra pounds. I know I am. And if I’m going to get any resemblance of a “summer body” back I’m going to have to stick to a healthy eating and exercise plan. The thing is, it will all be wasted effort if I don’t measure my progress regularly. There are all sorts of ways I could track my progress – scales, tape measure, BMI, muscle to fat ratio, or simply if I can fit into my favourite pair of jeans – but it’s important that I measure something! It’s the same with your business, but instead of trying to shrink to fit into those jeans, you’re looking to grow and expand. Similarly, there are number of ways in business that you can measure your success (or lack thereof) against your goals.

Key Performance Indicators are measures that we can use to understand how well we’re tracking against our business goals. They can be non-financial, such as number of leads converted to sales, or financial, such as sales turnover. Ultimately you’re in business to make money though, so it’s a good idea to have a few “go-to” financial KPIs in your line-up. Here are my top 5 financial KPIs.

1. sales growth

Sales growth is one of the most basic barometers of how successful your business is. Looking at total sales on its own might be fine, but unless your comparing it against something you can’t get an idea of how good or bad it is.

By tracking your sales month by month and calculating the difference you can see if your business is growing or shrinking in terms of sales.

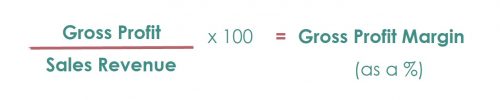

2. gross profit margin

Second on the list is Gross Profit Margin. This Is a really important measure as it can tell you how well you’re pricing your products or services.

Your Gross Profit Margin should be large enough to cover all your other expenses and still leave you with a profit.

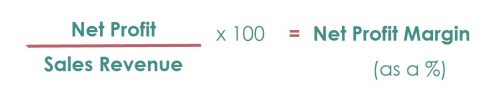

3. net profit margin

Your Net Profit is sometimes referred to as your bottom line. It’s the amount of money left over after all your costs.

So it follows that your net profit margin indicates the percentage of your revenue that is profit. This KPI is particularly helpful for setting future goals, projecting anticipated profits, and creating benchmarks to test later financial performance.

4. current ratio

This is an important one because it tells you if you’re generating enough income to pay your bills on time.

A current ratio of less that 1 would indicate that your business is, or very soon will be, struggling to pay its bills. So you want this figure to be more than 1.

5. return on equity

And finally Return on Equity. This KPI ratio measures how much you make from each pound invested in the business. In other words, how efficient are you at generating profits from what you (or your shareholders) have invested in the company?

Return on Equity is a useful KPI as you can, if you wanted to, use it to benchmark against other companies. It is expressed as a percentage, and the higher the percentage, the better you’re doing.